Is hydrogen development in the UK reaching a tipping point? The growth of digital hubs from Facebook to TikTok have made us all aware of the power of network effects. When a certain percentage of the one’s friends, contacts or favourite celebrities are on a particular network, it makes sense to join and becomes difficult to leave.

The same is true in industrial technology and energy; it’s why it is so hard to wean ourselves off fossil fuels. When there are petrol stations on every corner and everyone’s car runs on petrol it’s a pretty big incentive to keep making petrol cars.

Because oil is being pumped and refined into petroleum, it makes sense to build an industry around also turning oil into plastics, chemicals and other products. Winding down one of them impacts the rest, reducing economies of scale.

However, this can also work the other way. When a technology or energy source becomes more widely available, people start to find new uses for it. The emergence of hydrogen hubs across the UK is one such example.

Take for instance the East Coast Cluster being built around Teesside and The Humber and home to hydrogen projects including H2NorthEast, Project Humber H2ub, H2 Teesside, HyGreen Teesside and H2H Saltend. As well as sharing carbon storage resources provided by the Northern Endurance Partnership, the hydrogen being created is intended for a variety of off-takers, reducing the risk for the producers.

BP’s HyGreen Teesside project has agreements with customers including CF Fertilisers, global chemical company Venator, Northern Gas Networks and its potential home hydrogen trial, Ensus, operator of one of Europe’s largest renewable ethanol production plants, Tees Valley Lithium, which plans to build one of Europe’s first lithium hydroxide processing facilities, and Sembcorp Energy UK for the supply of green hydrogen to explore decarbonisation options for some of its assets at Wilton International on Teesside.

The hydrogen hub being developed by NGN, Ryze Hydrogen and Hygen Energy in Bradford, will produce hydrogen that is available for both transport and industrial customers, providing fuel for zero-emission trucks and buses as well as local businesses looking to decarbonise. It is no coincidence that the project is to be built on a decommissioned gas works that previously served as an energy hub for business and residential customers.

Teesside’s emergence as a national centre for hydrogen production has attracted capital to the region. In October last year, the UK government announced the £20 million Hydrogen Transport Hub competition in the Tees Valley, which seeks to explore how hydrogen can be used to create a cleaner and more efficient transport sector.

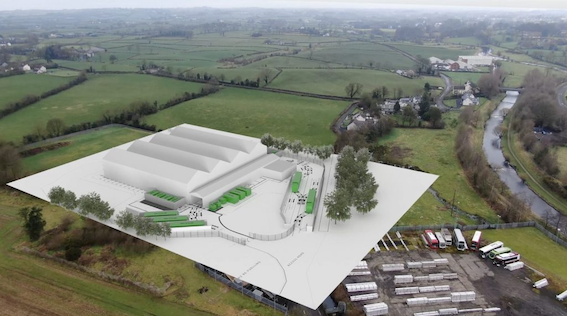

The hydrogen hub being developed by NGN, Ryze Hydrogen and Hygen Energy Holdings in Bradford (outer Bradford region pictured above), will produce hydrogen that is available for both transport and industrial customers, providing fuel for zero-emission trucks and buses as well as local businesses looking to decarbonise. It is no coincidence that the project is to be built on a decommissioned gas works that previously served as an energy hub for business and residential customers.

Even single customer projects, such as Wrightbus’s hydrogen production facility in Ballymena ( see plan pictured below), have the potential to seed network effects. The project will initially be able to produce enough hydrogen to run up to 300 buses, but has the potential to triple in scale as demand for hydrogen increases, creating economic opportunities in Northern Ireland while supporting decarbonisation efforts.

Most regions of the UK have hydrogen hub projects at least on the drawing board.

The most significant include Hynet North West, a major industrial decarbonisation cluster based around the northwest of England and north Wales. Projects include hydrogen production by Vertex Hydrogen, a hydrogen transport pipeline network from Cadent, and hydrogen storage facilities from INOVYN.

Hydrogen Southwest was launched in August of last year by the GW4 Alliance of leading universities in the UK’s southwest and Western Gateway, a grouping of regional government and enterprise bodies focused on net zero delivery.

Carlton Power has proposed three hydrogen hubs, in Trafford, Langage and Barrow, all of which are located with specific off-takers in mind, and are designed to take advantage of its renewable energy portfolio to produce green hydrogen via electrolysis.

Even single customer projects, such as Wrightbus’s hydrogen production facility in Ballymena (plans pictured), have the potential to seed network effects. The project will initially be able to produce enough hydrogen to run up to 300 buses, but has the potential to triple in scale as demand for hydrogen increases, creating economic opportunities in Northern Ireland while supporting decarbonisation efforts.

On the south coast on England, the Port of Shoreham in West Sussex where plans to host H2 Green, which will produce hydrogen to power the Port’s fleet of heavy goods vehicles and forklifts before ramping up production to serve the 800 HGVs that use Port of Shoreham daily for other organisations.

Portsmouth International Port is building a modular electrolyser to produce green hydrogen for the port and the local area as part of the Shipping, Hydrogen and Port Ecosystems UK (SHAPE UK) project.

Hydrogen East, based around Bacton on the Norfolk coast, will have access to the growing collection of offshore wind projects nearby, including Norfolk Vanguard and Sheringham Shoal.

Among the largest hydrogen developments in Scotland is the Aberdeen Hydrogen Hub, a joint venture between BP and Aberdeen City Council. The first phase involves building a hydrogen refueling facility for buses and trucks, powered by a solar farm producing more than 800kg of green hydrogen per day from 2024, enough to fuel 25 buses and a similar number of other fleet vehicles.

Phase two could see production scaled up to more than 3 tonnes a day for road, rail, freight and marine customers by 2030. Phase three could see hydrogen supplied for heat in buildings and export. Scottish hydrogen hubs are also being developed in Inverness, Fife, and the Cromarty Firth, among other locations.

Wales has also been getting in on the act. Wales & West Utilities was recently awarded funding for a research project aimed at reducing emissions from transport and heat with hybrid hydrogen and district heating systems.

We are only beginning to understand the potential synergies and network effects that can be generated by co-locating hydrogen production with other industrial and energy processes. The hydrogen economy is still young and the UK’s many hydrogen hubs are at an early stage. As they mature, they will attract more investment as businesses tap hydrogen to decarbonise.

To learn more about Ryze Hydrogen, click here.